Futures Trading

We are including in the lessons, charts, plus annotated copies of mr. There's a new commodity in town for investors to trade:

Gold Futures Trading Strategies How to use Money

Gold Futures Trading Strategies How to use Money

At the time, the spot price stood at around $1,600.

Futures trading. Ice brent futures use this method. An investor could potentially lose all or more than the initial investment. Needless to say, bitcoin futures are currently the most popular type of crypto futures contracts

The futures markets are regulated by the commodity futures trading commission (cftc). For example, if you buy west texas intermediate (wti) crude oil futures at a $55 with a three month expiration, regardless of the price movement. Crude oil futures , and more specifically, ‘light sweet crude oil futures’ are traded on the nymex exchange (new york mercantile exchange).

You can also trade futures of individual stocks, shares of etfs, bonds or even. The websites blocked in january 2021 are mostly foreign futures trading sites, utama stated. The last trading day of oil futures, for example, is the final day that a futures contract may trade or be closed out prior to the delivery of the underlying asset or cash settlement.

Expiry (or expiration in the u.s.) is the time and the day that a particular delivery month of a futures contract stops trading, as well as the final settlement price for that contract. Usually, most futures result in a cash settlement, instead of a delivery of the physical commodity. But this particular trading instrument, which involves an agreement to buy or sell an asset at a predetermined future price.

Contract language that allows adjustments to be made to the premium and commission features of a reinsurance treaty. Legal entities in indonesia or abroad that did not have a license from bappebti are not allowed to conduct futures trading activities in the country, including promotion or advertising, training, and meeting on futures trading in indonesia. Our top futures market is crude oil and many traders will agree that crude oil is a great market for trading futures with a day trading strategy, scalping, or even holding for swing trades.

They can last for a couple of minutes or at times, for most of a trading session. Futures trading is an investing activity typically reserved for speculators or companies that are looking to hedge against the future price of their products. Futures trading is one method for investors looking to maximize profits.

Futures trading refers to a method of speculating on the price of assets, including cryptocurrencies, without actually owning them. However, any individual investor with a margin account can participate in futures trading. Futures trading involves buying and selling futures contracts.

Mitchell founded vantage point trading, which is a website that covers and reports all topics relating to the financial markets. Speculate on a range of futures market, including indices, commodities and bonds, by opening an account now. Trade futures on the uk's number one trading platform.

Commodities, currencies and global indexes also shown. Futures trading strategies are a great way to grow both a small and large trading account. While swing trading stock and forex are more popular, futures are also suitable for swing trading.

A wealth of informative resources is available to those involved the commodities futures markets. Swing trading futures is the only multisession system on our futures trading toolbox. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style.

Futures and forex trading contains substantial risk and is not for every investor. Like commodity or stock futures, cryptocurrency futures enable traders to bet on a digital currency’s future price. Day trades vary in duration;

The cftc is a federal agency created by congress in 1974 to ensure the integrity of futures market pricing. Day trading is the strategy of buying and selling a futures contract within the same day without holding open long or short positions overnight. A futures contract might also opt to settle against an index based on trade in a related spot market.

Cory mitchell, cmt, is a day trading expert with over 10 years of experience writing on investing, trading, and day trading. Coverage of premarket trading, including futures information for the s&p 500, nasdaq composite and dow jones industrial average. An adjustable feature may include such features as sliding.

Enjoy quick access to the commodity prices / charts and quotes in which you are most interested using the personalized charts menu.you will also discover a large directory of commodity brokers, an online glossary of futures terminology and a brief educational course on commodities trading. Regulatory bodies, exchanges, brokerage firms and individual traders all play separate roles in the trading of futures. A type of financial derivative, futures allow you to buy or sell an underlying asset at a future date based on a price agreed upon today.

You need to be aware that the margin requirements are higher when attempting to swing trade futures.

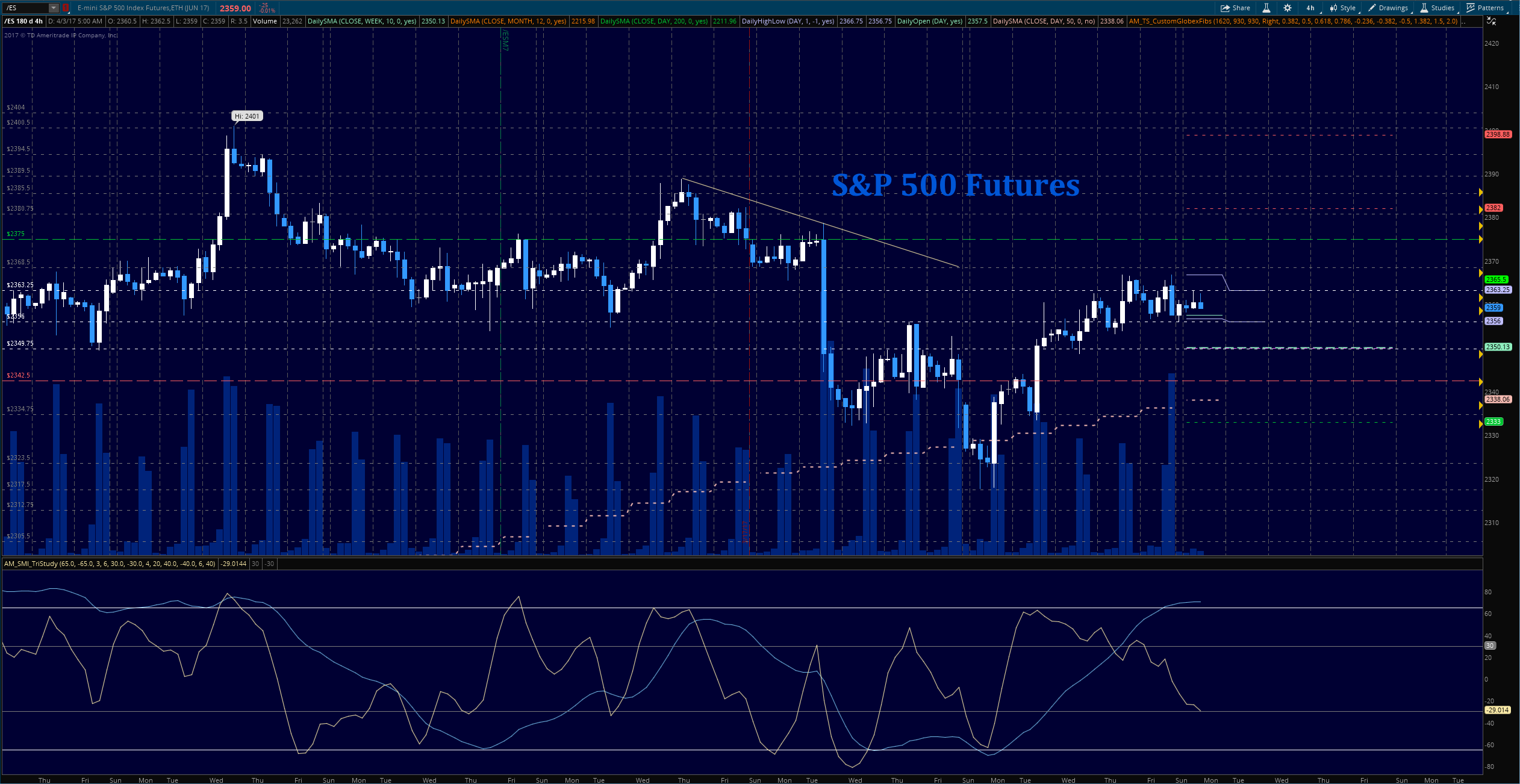

S&P 500 Futures Trading Outlook For April 3 See It Market

S&P 500 Futures Trading Outlook For April 3 See It Market

Wanted Australian SPI traders Emini Index Futures

S&P 500 Futures Trading Outlook For October 31

Futures trading course This futures trading course

Futures Trading Screen EminiMind

Beginner's Guide To Trading Futures Trading Futures For

Beginner's Guide To Trading Futures Trading Futures For

What Are Future and How To Trade Them ClayTrader

What Are Future and How To Trade Them ClayTrader

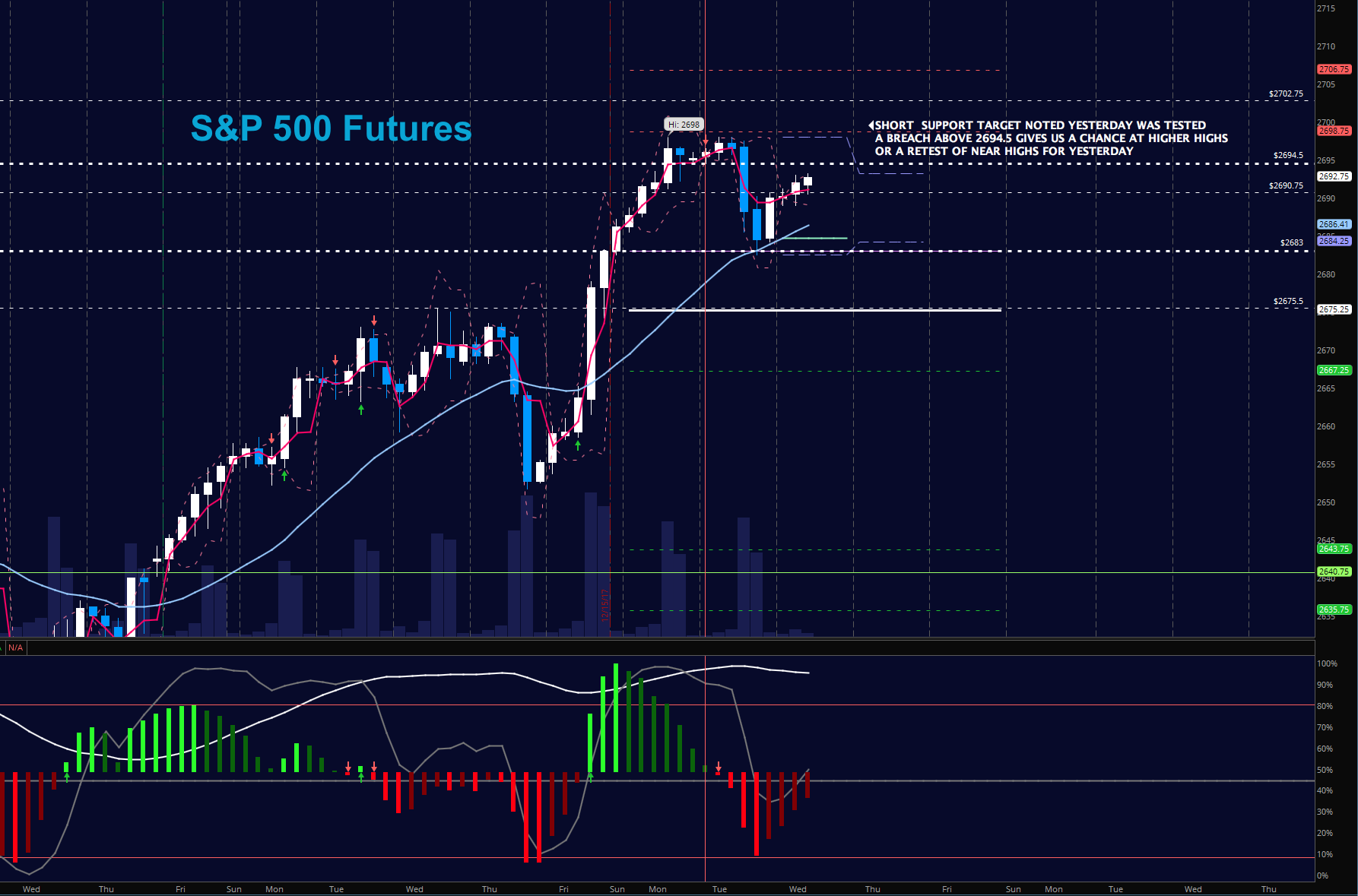

Stock Market Futures Trading Outlook For December 20 See

Stock Market Futures Trading Outlook For December 20 See

/daytradingESfutures-59ef7f669abed5001028141b.jpg) Profile of the S&P 500 (ES) Futures Market

Profile of the S&P 500 (ES) Futures Market

Basics of Futures Trading Explained NeuroStreet Inc.

Basics of Futures Trading Explained NeuroStreet Inc.

Free Futures Trading Guides and EBooks Daniels Trading

Free Futures Trading Guides and EBooks Daniels Trading

/close-up-of-abstract-pattern-767984067-5b8830e2c9e77c0050f04f94.jpg) Minimum Capital Required to Start Day Trading Futures

Minimum Capital Required to Start Day Trading Futures

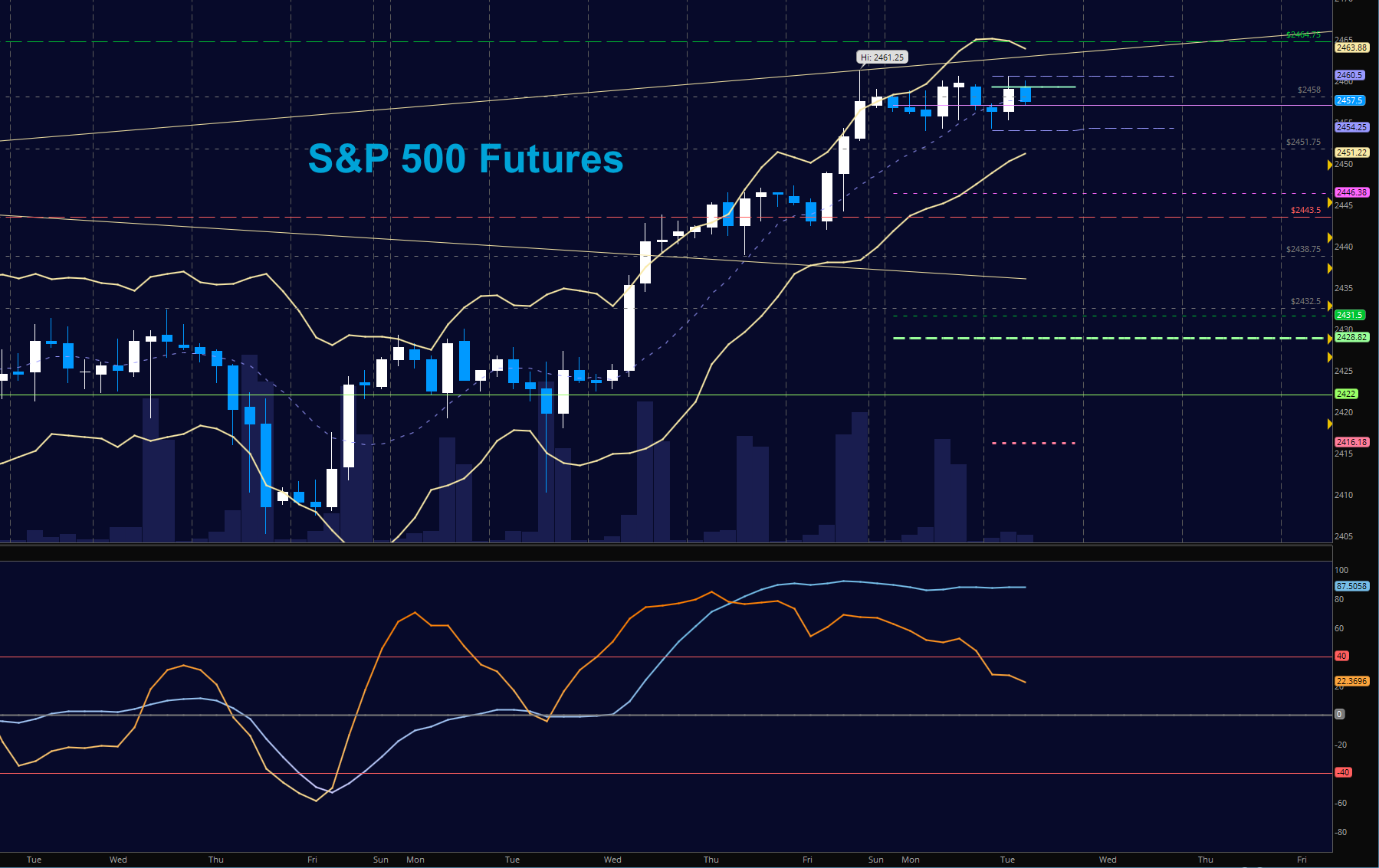

S&P 500 Futures Trading Outlook For July 18 See It Market

S&P 500 Futures Trading Outlook For July 18 See It Market

En apprendre davantage sur le trading des futures Meece

En apprendre davantage sur le trading des futures Meece

5 Advantages of Trading Futures Daniels Trading

5 Advantages of Trading Futures Daniels Trading

trading for a living sunday night trading futures bonds

trading for a living sunday night trading futures bonds

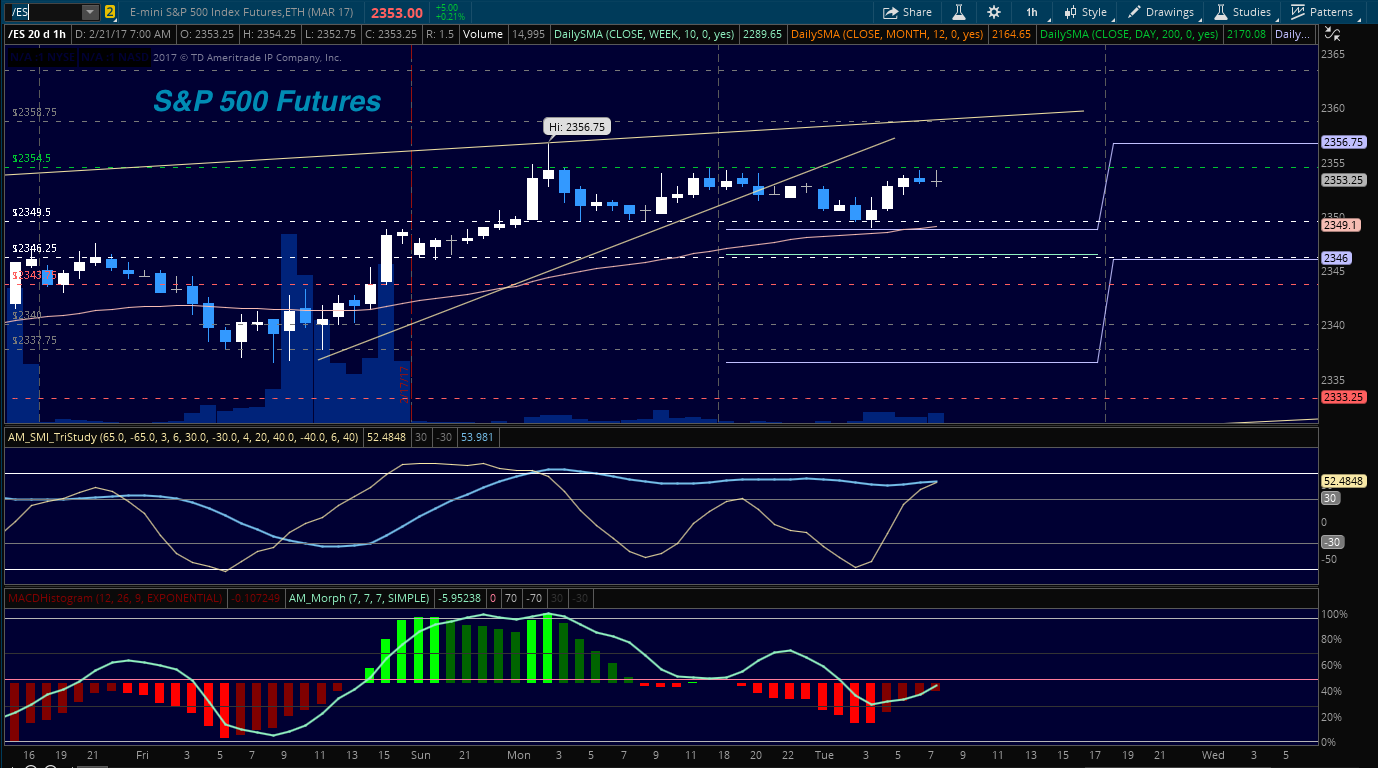

Stock Market Futures Trading Outlook For February 21 See

Stock Market Futures Trading Outlook For February 21 See

S&P 500 Futures Update Price Support Holding... For Now

S&P 500 Futures Update Price Support Holding... For Now

No comments